Introduction

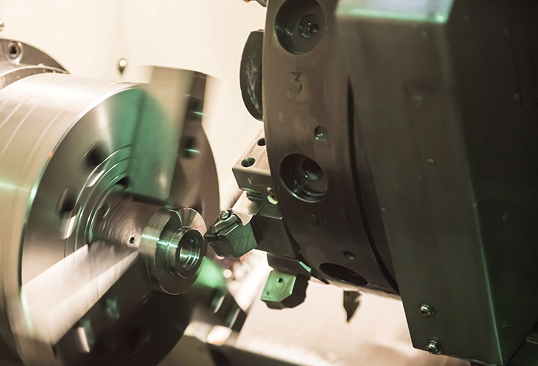

Manufacturing acquisitions can be lucrative but involve risks like customer concentration and equipment financing. Yaw Capital arranged financing for an engineer acquiring a $3.6M precision manufacturer.

The Challenge

- Revenue heavily tied to two customers.

- Expensive equipment needing updated valuations.

- Buyer had corporate but no ownership experience.

Our Solution

Yaw Capital secured a senior lender experienced in industrial financing:

- $3.6M package with favorable terms.

- Risk-mitigating covenants tied to customer contracts.

- Flexibility for future capex upgrades.

The Outcome

The deal closed in 82 days. Customer contracts were renewed post-closing, and the buyer grew revenue by 22% in year one.

Key Takeaways

- Customer concentration can be mitigated with covenants.

- Equipment-heavy deals require specialized lenders.

- Transition plans matter as much as financing.