We needed a blend of institutional and private debt for a healthcare deal. Yaw Capital pulled it together seamlessly.

Yaw Capital specializes exclusively in business acquisition financing, but no two industries are the same. Each sector has its own financing challenges — from cash flow seasonality to regulatory hurdles. That’s why we maintain relationships with lenders who understand specific industries and know how to structure loans that fit the unique risk profile of each market.

From dental and veterinary clinics to home health and outpatient facilities, healthcare acquisitions often involve high goodwill and strict licensing. Yaw Capital works with lenders that understand recurring patient revenue and reimbursement structures, making healthcare one of the most financeable sectors for buyers.

Tech businesses, Internet, SaaS platforms, and IT services firms are attractive but often misunderstood by traditional banks. Our lender network includes SBA lenders and private capital funds that specialize in recurring revenue models, ARR/MRR metrics, and digital valuations.

Acquisitions in eCommerce and consumer products require lenders who understand inventory, supplier agreements, and digital marketing metrics. Yaw Capital has helped clients secure SBA and capital markets loans for Amazon FBA sellers, Shopify brands, and multi-channel consumer companies.

Tech businesses, Internet, SaaS platforms, and IT services firms are attractive but often misunderstood by traditional banks. Our lender network includes SBA lenders and private capital funds that specialize in recurring revenue models, ARR/MRR metrics, and digital valuations.

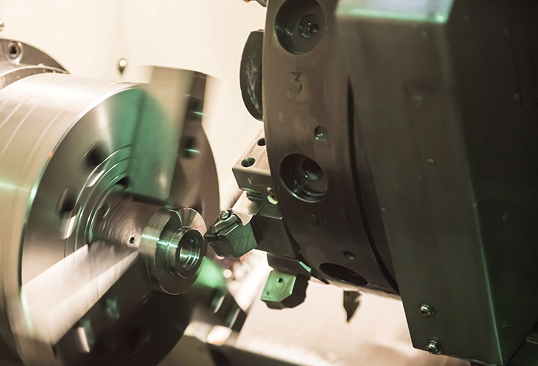

Manufacturing deals often involve equipment financing, customer concentration risks, and long-term contracts. Our capital partners know how to structure layered financing that accounts for both tangible assets and goodwill.

Accounting firms, marketing agencies, consulting groups, and staffing agencies are prime acquisition targets. Lenders often require proof of recurring contracts, and we know how to prepare packages that highlight these strengths.

From restaurants to fitness studios, franchise acquisitions are highly financeable when structured correctly. Yaw Capital has strong SBA and bank relationships with lenders experienced in franchising.

Generic financing often leads to lender declines. At Yaw Capital, we know which lenders to call based on the industry you’re acquiring in, saving you time and dramatically improving approval odds.

Healthcare Sponsor

We needed a blend of institutional and private debt for a healthcare deal. Yaw Capital pulled it together seamlessly.

Franchise Investor

No one else had access to the franchise lenders we needed. Yaw Capital closed $30M in financing with incredible speed.

Manufacturer

Our manufacturing expansion needed a creative structure. Yaw Capital built a senior and subordinated package that fit perfectly.

PE-Backed Buyer

They closed a $22M brand deal for us by sourcing mezzanine debt. Without Yaw Capital, we would have had to give up much more equity.

SaaS Acquirer

Yaw Capital delivered us a loan to buy a business when we thought equity was our only option. Their network is unmatched.

Landscaping Business Owner

They didn’t just close my landscaping deal—they also negotiated working capital terms that made running the business easier.

Brewery Buyer

Many lenders wouldn’t touch breweries. Yaw Capital knew exactly who to call for finance to buy a business.

CPA Firm Owner

Buying out my partner was emotional and complicated. Yaw Capital made the financing side stress-free.

Auto Shop Buyer

The auto repair deal had lender concerns, but Yaw Capital presented the valuation so well that we got it done.

Gym Franchisee

Expanding gyms is capital intensive, but Yaw Capital found the right SBA partner for me. They knew the fitness space inside and out.

Cleaning Company Buyer

As a first-time buyer, I needed hand-holding. Yaw Capital made sure I understood everything and matched me with a lender who moved fast.

Specialty Food Business Owners

They helped us buy our dream food business and even secured business acquisition funding for the new equipment we needed. Couldn’t ask for better.

Home Healthcare Buyer

Healthcare deals are complex, but Yaw Capital navigated every step. Their lender relationships made the difference.

Childcare Operator

I didn’t think buying another daycare would be doable so soon, but Yaw Capital structured financing that covered licensing and upgrades.

Staffing Agency Buyer

The SBA loan process looked impossible until Yaw Capital stepped in. They found a lender who understood the staffing industry and made it work.

First-Time Buyer

If you want a partner that knows SBA inside and out, Yaw Capital is it. They helped me buy my dream business without unnecessary stress.

Outdoor Retail Buyer

The process was faster than I expected. Yaw Capital’s team knew how to push things forward and keep the lender accountable.

HVAC Buyer

I wasn’t sure I could get financing with limited capital, but Yaw Capital structured a deal with a seller note and SBA debt that worked perfectly.

Manufacturing Company Buyer

From day one, they treated me like a partner. Their SBA expertise and lender relationships gave me confidence at every step.

Marketing Agency Buyer

Other brokers told me my agency wasn’t financeable. Yaw Capital proved them wrong and found a lender who valued my recurring revenue contracts.

Dental Practice Owner

I was buying out my mentor’s dental practice and needed someone who could bridge the financing gap. Yaw Capital secured an SBA loan and guided me every step of the way.

Multi-Unit Franchisee

As a franchise operator, I’ve dealt with banks before. Yaw Capital delivered terms I didn’t think were possible and made expansion painless.

DTC Brand Buyer

The team understood online businesses better than any bank I spoke with. They matched me with a lender who ‘got it’ and closed my eCommerce acquisition in record time.

IT Services Buyer

Yaw Capital made buying my first business possible. I was overwhelmed by the SBA process, but they handled everything, found the right lender, and got me across the finish line.

Freight Company Buyer

Our trucking acquisition had a lot of moving parts. Yaw Capital knew which lenders were comfortable with logistics and got the deal closed despite industry volatility.

Reach out to YAW Capital for loans, business discussions or general inquiries.